A lot of people talk about the need for #economic growth. It is routinely presented as the “silver bullet” to fix all big problems in the world. Want to end world hunger? Economic growth. Rid the world of mass #poverty? Economic growth. Tackle global warming and protect the environment? Economic growth.

This knee-jerk response is so engrained in policy circles that it is the only offering put forth by the #United Nations Sustainable Development Goals. After several years of discussion and debate, the best they can do is say we’ll solve the wicked problems of the 21st Century with “inclusive economic growth”.

The mantra of economic growth is repeated so often that otherwise highly intelligent and well educated people all over the world treat it as if it were a law of nature. But hidden beneath the veneer of confidence lurks an embarrassing secret — almost no one knows what causes economic growth! It has become a belief not to be questioned, one of the great dogmas of our time. Simply ask any corporate CEO, head of state, or representative from the United Nations where wealth comes from and they will not be able to give you a straight answer.

You may hear them say that wealth comes from “innovation” and “free enterprise”. Or that it appears in the hard work of entrepreneurs who “create jobs” and introduce new “products and services” into the market. But this doesn’t say where the wealth comes from at all. It is like asking someone where the colour blue comes from in the atmosphere and having them say it comes from the sky. That isn’t an explanation; it’s a stand-in for real knowledge that lacks clarity about the physical mechanisms involved. (Side note: A proper answer would be that the colour blue comes from the diffraction of solar radiation as it interacts with air molecules that selectively absorb, scatter, and reflect solar energy in a manner highly sensitive to wavelengths of light — as computed in the sensory/perception circuitry of the human visual system in our brains.)

One might ask why there isn’t a better physics-like answer to the question of economic growth from members of the #economics profession? The short answer is that a religious dogma has control over the official storyline of economics. Those economists who approach their work like real scientists (yes, they exist!) are not the ones who guide economic policy most of the time. Instead it is morally-driven ideologues that espouse the worldview of#Neoliberalism who routinely call the shots. And their story of #wealth creation is like a bucket with holes in it. Inspect it, even briefly, and you’ll see it doesn’t hold water.

The Neoliberal Story of Wealth Creation goes like this:

Once upon a time, the world was full of unused resources. Clever business people came along and found ways to add value to these resources by extracting them for use in industrial processes. Thanks to the invisible hand of unfettered markets (keep governments small enough to drown in a bathtub and only allow regulations that support the hoarding of wealth by holders of financial capital), this “value add” creates wealth in the form of rising GDP and the creation of jobs. All you have to do is let the wealth “trickle down” from the super rich as they pile up increasingly huge masses of #money.

This story will be familiar to all of us. We’ve heard it repeated so many times by elected officials and talking heads in the media that it has the look and feel of truth, what Stephen Colbert would describe as “truthiness”. But note how this story DOESN’T ACTUALLY SAY how wealth is created. All it does is describe how money gets stockpiled by the rich — those who have money invest it in ways that make them even more money.

It’s a circular logic without a foundation. Or, to use the metaphor again, a leaky bucket that seems to hold water until we try to put something in it and voila! We get a soggy, dripping mess on the floor.

If the standard narrative doesn’t tell us where wealth really comes from, where do we need to look for a properly scientific answer? We have to look at two things: (1) The actual physics of economic systems; and (2) how poverty creation works.

The Actual Physics of Economic Systems

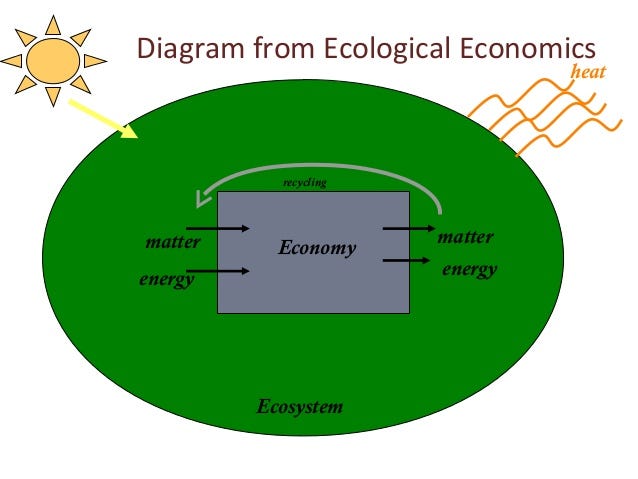

Pick up any introductory physics text book and you’ll find the most basic thing every physical scientist knows, that energy and mass are never created or destroyed. Energy and matter constantly dance back and forth in the spacetime continuum that makes up all the material stuff in the Universe.

Things get fuzzy at the starting point of the Universe, when our mathematical ability to describe what happened slams up against the brick wall of ignorance. We simply don’t have the tools to probe further. But as far as we can tell, once the Big Bang set things in motion there has never been a moment when mass/energy was created or destroyed. This fundamental law of nature plays out in economic systems — which are, by necessity, part of the natural world. (Have you ever seen an #economy that wasn’t?)

Economic systems cannot “create” wealth in any way that violates the laws of physics. It can only take mass and energy and change how they are arranged in space and time — the quintessential definition of information — by building up systems of production through cooperative human activities. As obvious as this is to point out, the story of wealth creation offered by Neoliberalism fails to acknowledge the fact that value-laden material was already “information rich” thanks to four and a half billion years of planetary and (and 3.8 billion years of biological) evolution on Earth.

The physics of economic systems requires that we acknowledge a basic truth; that wealth arises from the natural world. It is part of nature. And yet, as the Neoliberal Story described above starts out, there is a presumed separation of markets from the natural environment.

Their story of wealth creation pretends that nature had no value before it was monetized by industrial activities. And this is why they don’t have a firm footing to stand on about the the origins of wealth — to presume that wealth “appears” when business activities are performed is to miss out on the real action taking place in the previously-existing ecosystems of information that came into being through physical and biological evolution.

Said in more concrete terms, the reason we place a big fat zero in the number column of our spreadsheets for the price of nature is because it is presumed to be without value. It doesn’t make the accounting books because the religious dogma of Neoliberalism rejects this physical truth as one of its core beliefs.

How Poverty Creation Works

At this point in the discussion, we can see that wealth was already there in the form of natural environments that made life possible for humans to behave as economic beings. This becomes evident when we look at the flip side of wealth creation in modern economies, where poverty creation makes possible the hoarding of wealth in Capitalist systems.

What do I mean by “poverty creation”? My collaborators and I wrote a longer article about it for Fast Company (read it here). In brief, it can be described like this:

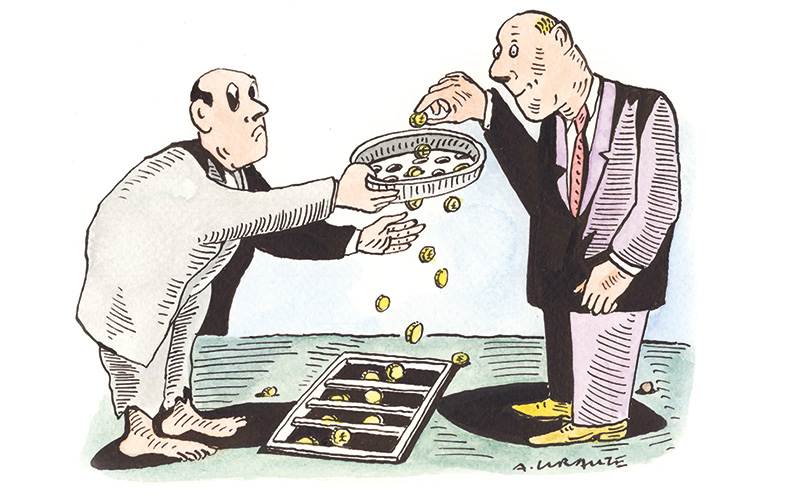

#Poverty is created when the political expression of an economic system (for production and allocation of material information) takes sources of wealth away from some people and transfers it into the hands of other people, often changing forms (like the conversion of mass to energy) along the way.

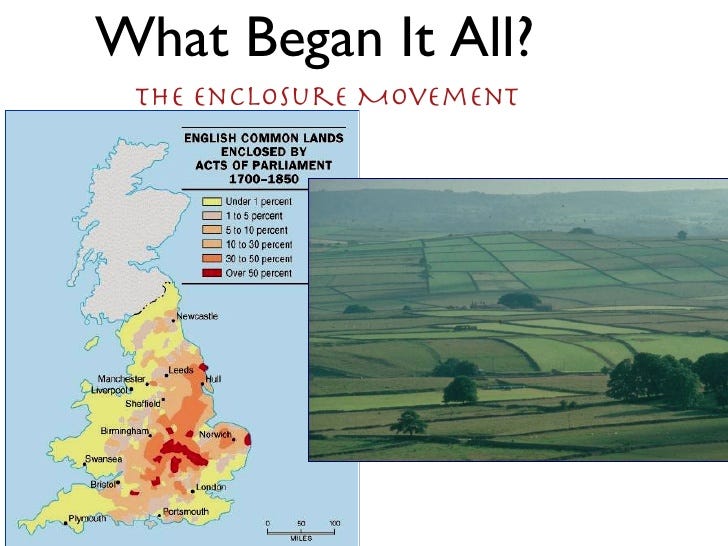

A concrete example is the Enclosure Movement of 17th Century Britain.

It was a time when peasant farmers were forcibly removed from their land, where they had engaged in subsistence farming for generations. Wealthy merchants and aristocrats began a systematic campaign to privatise the land-based commons and kick the peasants off their land, which they turned into sheep runs for the highly profitable wool industry. This became known as the “enclosure” movement, and historians regard it as the birth of #capitalism as we know it today.

Millions of people were forcibly displaced, creating a monumental humanitarian crisis. For the first time in English history, the word “poverty” came into common use to describe the masses of people who literally had no way of surviving. They poured into cities like London and scratched out a living in sprawling slums — fodder for Dickens’s bleakest novels.

In this example, we can see how the aristocracy “created wealth” by transferring shared ownership of land into the new form of privately held landholder deeds. Peasants were separated from the means to grow their own food and became wage labourers who worked the land to pay rent — with the corollary movement of money from merchants to landowners as they amassed ever larger amounts of financial wealth.

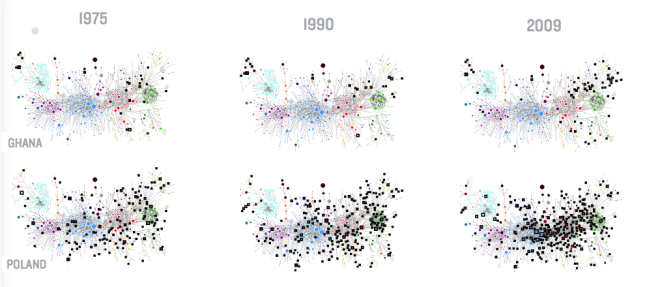

The same process can be seen in other places where mass poverty “appeared” during the Industrial Age — through colonial conquest by the British Empire in India; slavery followed by resource grabs across the African continent; and CIA-backed military dictators in Latin American countries that instituted “business friendly” practices for foreign investors. We have our current distribution of wealth around the world thanks to a long history of colonialism by Western empires followed by economic imperialism in the post-colonial patterns of economic development that followed.

The West is rich because they took resources from other parts of the world. And the top earners in all nations accumulated their fortunes by extracting it from the productive labor of workers within their own countries (and by forcing “free trade” agreements that used market competition to suppress wages on increasingly global labor markets).

No story of wealth creation is complete without a corresponding story of poverty creation. This has an analogue in the physical sciences — what is known as entropy (the measure of disorder in the spatial or temporal arrangement of energy). Now that we know how to translate the findings of physics into a description based on information, it should not surprise us to find that the distribution of wealth is a kind of information in its own right.

Where there is order in an economic system, there must correspondingly be a measure of disorder somewhere else in the system… as physicists would say, every thermodynamic process there is an increase in entropy. Even in ideal circumstances it can only stay the same. Entropy never goes down.

The Real Story of Wealth Creation

Now we are in a position to tell the real story of wealth creation. We know that wealth is physical, subject to the laws of nature, and rises or falls depending on how it is arranged in space and time. This tells us that wealth is a kind of information inherent in social systems.

The definition of wealth goes something like this:

Wealth is a productive capacity of any natural ecosystem that rises or falls based on the spatial and temporal arrangement of matter and energy. Thus it is a kind of “information complexity” that can be measured using a suitable set of tools. It is subject to physical laws — in particular, the Law of Conservation for Mass/Energy and the Second Law of Thermodynamics about the nature of entropy. Wealth created by transferring productive capacity from one group of people will correspondingly create poverty for any other group of people that become deprived of the productive capacity by the process. Any kind of economic growth in the real world will be subject to these constraints.

It is vital that we understand the physical nature of wealth so we can envision and build economic systems that are capable of (1) reducing chronic inequality in the world; (2) recognising the inherent value of nature as a foundational building block for any economic system; and (3) exploring the ‘design space’ of all possible economic systems to find those best suited for planetary sustainability.

What we can take away from this commentary are the following:

- Economic growth is a process of changing the information content of human systems — which are necessarily constrained by the laws of nature.

- Wealth creation is ontologically bound to poverty creation as an expression of the physical concept for entropy in social systems. Any economic system that increases the hoarding of wealth for some will correspondingly keep others from accessing wealth.

- Economic development is fundamentally a process of evolving the social complexity of information. Some configurations of knowledge, skills, and built structures will lead to economic thriving. Others will lead to economic dysfunction.

- Ideology has trumped science for too long in economic policy. It is time to restore the credibility of scientific guidance and dispel the dogmas that continue to plague economics.

I hope this essay brings additional clarity to discussions you might partake in about the future of economic development. We will not get to planetary thriving with unquestioned, dogmatic, and unscientific beliefs about economic growth.

Now is the time to fully explore the science of credible economic thinking and apply the best of this knowledge to the great challenges confronting humanity.

This article originally appeared on Medium.com on 31st July 2015.

I wish the author had used plainer language. I intended to share this on FaceBook, but the people who would benefit from seeing it would seize up mentally at the phrase “ontologically bound” and would reject all the ideas proposed earlier in the essay, that they might have been going along with. Even “one might think” instead of “you might think” is off-putting to the USA Freedom Fry-ers I am aiming at.

Swallow your pride! Make a dumbed-down version for export to the colony!

Hello Cass,

You are right that this article is not written for the uneducated audience. I wrote it to engage with people who have training in economics and related fields (or at least are well read on the subject). It would be great if there was a magical way to rewrite it with language that those “USA Freedom Fry-ers” you hope to persuade would take in and change their minds.

Having studied cognitive science (and political psychology in particular) for nearly ten years now, I’m afraid these ideas are quite likely to activate worldview-preservation defenses from them anyway — the facts of the matter likely wouldn’t stick even if written in plainspoken language.

That said, there is need to translate key ideas from this sophisticated argument into simple stories people can relate to… a natural followup to a piece of analysis like what I wrote here. I don’t see this as a flaw in the article itself — rather it is one step in a long chain of idea cultivation that can grow from here.

Hope this is helpful!

🙂

Really enjoyed this read, i think there should be some disclaimer stating that “to truly understand economics through a scientific lens you’ll need an understanding in certain laws of physics” as that seems to be your premise. Which I had trouble comprehending whether you’re arguing that as a result of the big bang all wealth possible is physically finate and tangible or wealth can be abstract and can keep being creating/accumulated without an increase in physical production. I.e cyber-wealth creation

It’s not the vocabulary that makes this article difficult to read, the flow of it needs improvement as the author seems to ramble on with so many unncessary adjectives and adverbs. At Stanford University, our professors in Journalism/Business courses stressed to us on the importance of shortening complexities into as little writing as necessary to get your point accross… As it actually requires MORE critical thinking and skill to shorten 3 pages of complex idea’s into only 1 page, versus taking 1 page and rambling on to meet the 3 page requirement.

This blog as it sits is not a final draft, shorten it to get your point across as quickly as possible. Short and to the point is more effective these days.

Wealth is stored value. Value is whatever makes one’s life better. That doesn’t have to be monetized. Value is created by re-arranging matter and energy to a form that is more highly valued. The assignment of value is a subjective human function. While it is a difficult read, “The Wealth of Nations” would be instructive. Specialization of labor and its concomitant increase in productivity greatly aids the creation of wealth. Your example of the enclosure movement only highlights the rearrangement of wealth, not the creation of poverty. The farmers were always poor, aka subsistence farming. The owners put the land (resource) to higher use and created more wealth, which enabled them to build the factories that housed the erstwhile farmers. Transitions always cause displacements, which are painful for some and beneficial for others. Focusing only on the negative doesn’t do justice to history.

Hi David,

I think you’ve hit on one of the key features of the argument I laid out in this article — which is that human ecology is a process of evolving the arrangement of those productive structures in society. Some activities will lead to greater shared prosperity and others will lead to hoarding and disenfranchisement. And in both cases, the ecological factors remain important because entropy is involved at the whole system level.

My reason for focusing on the negative is that typically the stories of wealth creation blindly assume ONLY the positive dimension (e.g. increases in GDP or some other metric) and do not acknowledge that inequality is a feature, not a bug, of any economy designed for wealth hoarding by elites. It happened in pre-capitalist societies throughout the history of empires and civilizations. And it continues to this day in the form of Neoliberal capitalism that uses a set of moral arguments to justify the status quo.

I believe we can do much better than this — cultivating a global political economy that is both inclusive and democratic and that is in harmony with the Earth’s living systems. Getting from here to there requires that we acknowledge the dark side of capitalism (while holding strong to the aspects of open market economies that are adaptive and valuable).

Very best,

Joe

My great consern today is, that people do not get it, that we are in deep trouble in the word with these main global issues linked together, which naturally are sustainable development, unfair global economy and failing politics and democracy. And the time to change direction is very, very short.

I have taken part into various activistic ”green”(mostly)organisations during past 30-40 years. And there has never been lack of fine and accurate information, but the question seems to remain, how to get your message trough to ordinary people.

I have come to conclusion, that people do not care much of issues, witch are ”going to happen” in the future, like climate change. I assume, that it`s too difficult a task to take time from your personal life to get an understanding of such huge matters (and all the backgrouds behind the headlines). That´s why, I regon, people usually rather close their minds, just to protect their own personal well being.

To wake people up, in my oppinion, there has to be something, that they can see as a treath to their ”present” personal life or at least they can feel more familiar with the issue in their own lives. Inequality and money might be the major issues, that everybody could take a stand for and could form an oppinion of?

I wonder, if the important messages were simple and easy to take in, could it help to get them through? I belive, that YouTube short films could work to get attension at least into global economy + inequality issues (there are lots of short-films, which are as well entertaining).

How about if your organisation sets a goal to send Tube-links to ”everyone” (by facebook etc.), could it help to wake people up and get their attention? Would they by chance after that even start to look more information, knowledge, and strt step by step get more active?

You surely know for examble Thomas Piketty´s and Jeffery Sachs´s ideology. How many people in the world have ever heard of them, I wonder. My personal goal is to make the global economy and it´s effects better known to everybody. My wish is, that in the following few years basics of capitalistic financial structures will become a public knowledge. If not – there might be a strange looking world waiting for the younger generations.

Best rgs and all the luck for your great organisation!

In Spire

”How the global economy works”:

inequality money , uses of banking video

Positivemoney.org – THESE FILMS HAVE SUBTITLES IN MANY LANGUAGES

https://youtu.be/ONukGA09MkI

28.3.2015

To measure income inequality in a coun- try and compare this phenomenon among countries more accurately, economists use. Lorenz curves and Gini indexes.

what´s wrong with the money multiplier?

https://www.youtube.com/watch?v=SkAzDrrKkME

https://www.youtube.com/watch?v=aOJ93tAbPP0

https://www.youtube.com/watch?v=rVFetg5OPN8

https://www.youtube.com/watch?v=QPKKQnijnsM

https://www.youtube.com/watch?v=ik1y4ZNSjek

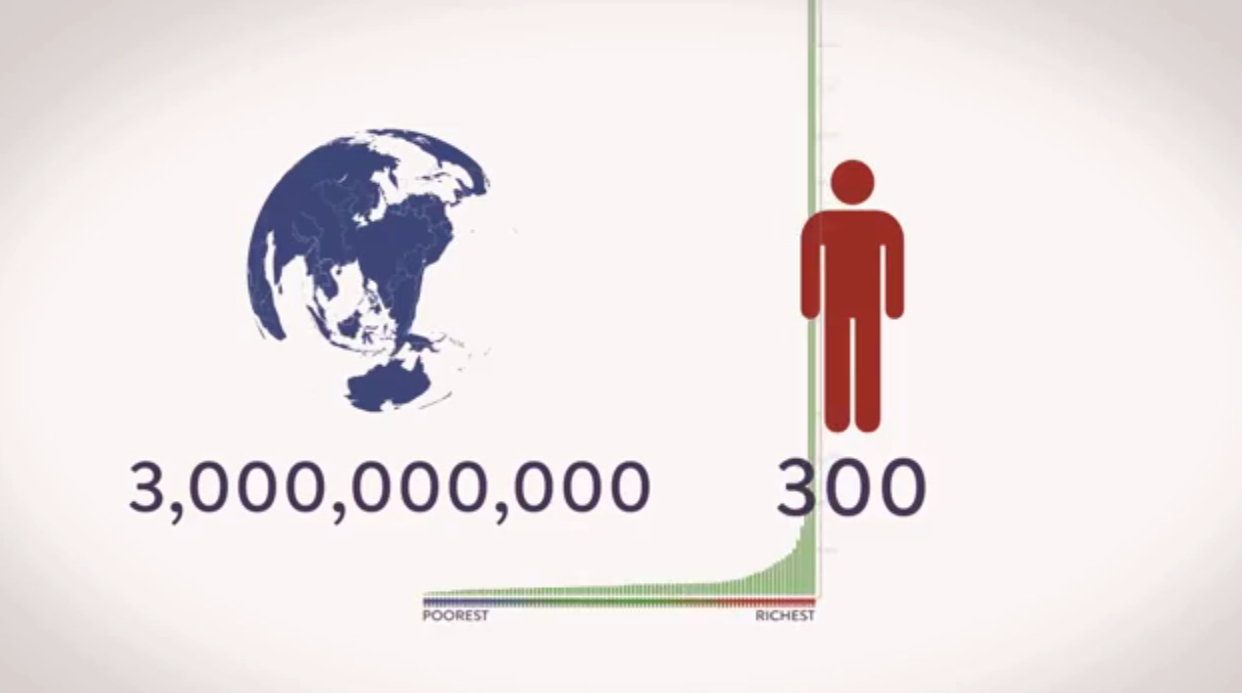

Global Wealth Inequality – What you never knew you never knew

https://youtu.be/ZaIM8DnC2eg

28.12.2014

http://therulesblog.wpengine.com/campaigns/

The Collapse of The American Dream Explained in Animation

11.1.2011 https://youtu.be/mII9NZ8MMVM

Debt Crisis 2015 United States of America Explained in a Simplified Way

https://www.youtube.com/watch?v=Jjv-MtGpj2U

12-Year Old Child Reveals One of the Best Kept Secrets in the World

https://youtu.be/JHQOX8EVNmE

15.5.2012

12-year old exposes the immorality of the global banking system and why sound money is essential to freedom and stopping the spread of misery on this planet.

Wealth Inequality in Canada

https://www.youtube.com/watch?v=zBkBiv5ZD7s

https://www.youtube.com/watch?v=uWSxzjyMNpU

Wealth inequality in the UK

The European Debt Crisis Visualized

https://youtu.be/j4_tyEl84IQ

9.4.2015

Feb. 12 (Bloomberg) — At the heart of the European debt crisis is the euro, the currency that tied together 18 countries in an intimate manner. So when one country teeters on the brink of.

The Economic Collapse of Greece (full version 8 min). Whiteboard Animation by Angelow https://youtu.be/VfNBNlZPig4

19.8.2012

The world in the last 200 years!

https://youtu.be/e8OEuj6-pVg

JEFFERY SACHS: The Age Of Sustainable Development

https://youtu.be/ksZaAqRA5qg

13.3.2014

IIASA/OeAW Public Lecture Series, Lecture 4.

Jeffrey Sachs discussed the need to address the intertwined challenges of economic development, social inclusion and environmental sustainability holistically as part of The International Institute for Applied Systems Analysis (IIASA) and the Austrian Academy of Sciences joint public lecture series.

J. Sachs LSE -London School of Economics and Political Science

https://youtu.be/EadvEChBNUA

5.2.2015

Speaker: Professor Jeffrey D. Sachs

Thomas Piketty, Paul Krugman and Joseph Stiglitz: The Genius of Economics

https://youtu.be/Si4iyyJDa7c

6.3.2015

An Economy for the 99%: Josh Lerner and Connie Razza

https://youtu.be/qQEggFn2Stc

11.8.2015

Can budgets and even the federal reserve be brought under public control? One radical tool for grassroots democracy that is taking hold is Participatory Budgeting. Josh Lerner is co-founder and executive director of the Participatory Budgeting Project and is the author of two books, both released last year: Making Democracy Fun: How Game Design Can Empower Citizens and Transform Politics, and Everyone Counts: Could Participatory Budgeting Change Democracy? Also on the show: what is the Federal Reserve, and what role could it have? Connie Razza works with the Center for Popular Democracy and their “Fed Up” campaign, working to make the federal reserve work for the 99%.

The Super Rich – The Rise Of The Super Rich Untold Wealth Of The One Percent 1

https://www.youtube.com/watch?v=oCcLEAtcgic

1.10.2014

Neoliberalism has brought out the worst in us

Paul Verhaeghe

An economic system that rewards psychopathic personality traits has changed our ethics and our personalities

Paul Mason – is capitalism dead? | Guardian Live

23.7.2015

In the wake of the financial crisis and with the rapid rise of new technologies, award-winning economist and journalist, Paul Mason, believes we are on the cusp of a seismic economic shift, of a kind yet to be seen in human history.

Subscribe to Guardian Membership ► http://bit.ly/subgdnmembers

Paul Mason: Is new tech killing capitalism? – Tech Weekly podcast

http://www.theguardian.com/technology/series/techweekly/podcast.xml

In the wake of the financial crisis and with the rapid rise of new technologies, award-winning economist and journalist, Paul Mason, believes we’re on the cusp of a seismic economic shift, of a kind yet to be seen in human history. So has capitalism had its day? Watch him argue his case with Douglas Murray, Zoe Williams, Julia Powles and Pat Kane. https://www.youtube.com/watch?v=4HMs0kkUvq8

Richard Wolff and Cornel West Talk About Capitalism and White Subremacy

https://youtu.be/4zYAH-BZZTs

28.7.2015

A conversation about capitalism with two brilliant minds, Cornel West and Richard D. Wolff, together in a rare joint appearance. Richard D. Wolff is Professor of Economics Emeritus, University of Massachusetts, and author most recently of Capitalism’s Crisis Deepens: Essays on the Global Economic Meltdown 2010- 2014/ Dr. Cornel West has written or edited dozens of books, including classics like Race Matters, and Democracy Matters. His most recent is Black Prophetic Fire, written in conversation with Christa Buschendorf. Also in the show, activist Manju Rajendran tells us about a small business that is successfully operating under an anti-capitalist economic paradigm. And Laura raises questions about the record-setting settlement with BP over drilling disaster in the Gulf Coast.

Do You Actually Understand What ”Socialism” Is?

https://youtu.be/VQqRHNR6lOw

6.8.2015

Stanley Aronowitz: Poverty, Politics, Progressives

https://youtu.be/sXHCQrWFyvQ

15.11.2014

Richard Wolff interview of Standely Aronowitz

https://youtu.be/d3Jf086mz0w

5.6.2013

‘The Game is Rigged’: Richard Wolff

https://youtu.be/XlhFMa4t28A

14.2.2015

ACLU SoCal, L.A. Progressive and Occidental College hosted Richard Wolff for a discussion on economic rights and reform, on February 10, 2015 at Occidental College.

Richard Wolff: On Bernie Sanders and Socialism | #GRITtv

https://youtu.be/IhH-PWjR3b0

14.7.2015

This week: On Sanders and Socialism. Is socialism still an American taboo? Not so much, says professor Richard Wolff; nor was it in the past, says Nation columnist John Nichols. Richard D. Wolff is Professor of Economics Emeritus, University of Massachusetts, and a Visiting Professor in the Graduate Program in International Affairs at the New School University in New York City.

Global Capitalism: July 2015 Monthly Update

https://youtu.be/En4rRo07axE

22.7.2015

Global Capitalism: Monthly Economic Update Richard D. Wolff

Global Capitalism: August 2015 Monthly Update

https://youtu.be/Vq5JKjmArVs

Stiglitz on globalization, why (,) globalization fails?

https://youtu.be/sV7bRLtDr3E

4.1.2013

Globalization, Technological Change, and Inequality: Jeffrey Sachs and Paul Krugman in Conversation https://youtu.be/K_GtNgUxIJQ

25.6.2015

Paul Krugman: Europe`s Two Depressions

https://youtu.be/Z8u8x5SWJ88

23.7.2012

Paul Krugman, professor of economics and international affairs at the Wilson School, Nobel Prize winner and New York Times columnist was the keynote speaker at the inaugural conference of the Julis-Rabinowitz Center for Public Policy and Finance at the Woodrow Wilson School on April 19, 2012.

Bernie Sanders + Noam Chomsky; Deciphering Foreign Policy Jargon

https://youtu.be/CvZRsdHgxgA

23.6.2015

Follow @pplswar

Aired on May 20, 1985. Part II unavailable at this time.

Interview – Thom Hartmann – The Crisis of Western Culture

https://youtu.be/poMPeSx_WnY

30.7.2009

Interview with Thom Hartmann author of “Threshold: The Crisis of Western Culture”

Martin Armstrong: ”There´s No One in Control. It´s Like A Taxi Driven By A Kangaroo”

https://youtu.be/-ooVFoVQMDY

19.6.2015

David Harvey: The 17 Contradictions of Capitalism and the End of Capitalism

https://youtu.be/PnWG0KpMnms

28.5.2015

“Seventeen Contradictions is the most dangerous book I have ever written. It is also the latest (and maybe the last) of a series of books that I refer to in retrospect as “the Marx Project”.”

David Harvey (May 19, 2015 http://www.davidharvey.org)

Hi Inspire,

Apologies for the ridiculous delay in responding to your comment here, but I wanted to thank you for taking the time to respond so comprehensively and wondered if you’d ever thought about putting your thoughts together in a longer article as part of our community? It’s possible to self-publish on the website.

Let me know if you need help!

Thanks,

Elsie

While I am sympathetic to the intention, and recognise some useful insight in here, overall this is pretty incoherent. At different points in the article, wealth is presented as a social construct (which I would agree with) or, where it suits the case, as a physical property (therefore subject to physical laws). I am not a physicist, and apologies to you if you are, but my sense is that you are throwing around concepts like entropy in a pretty dubious way.

Wealth creation does often entail poverty creation, and ‘progress’ can be mere exploitation, technological gains can lead to social losses etc. All agreed. However, it does not help challenge the neoliberal worship of free markets to sugggest that all wealth creation is mere redistribution. (OK, ultimately the universe is just moving the same mass / energy around, but frankly I care more about some arrangements of mass / energy than others, and while other people will have a diversity of views – which is good – there is likely to be some common ground).

Also, while I agree that mainstream economics is ridiculously reductionist, there are also difficulties inherent in an environmental economics that starts to put value on nature. Once we put a monetary value on a natural resource, it becomes open to ownership, manipulation, commodification, derivatives etc. Or in other words, do you really want to give more power to finance?

I personally think that there are much simpler ways to challenge the hegemony of neoliberal economic thought, than to push grand alternative physical-economic theories of everything. That is basically buying into their frame, just moving the bits around. I agree we do need to challenge narratives, but how about instead talking about community, beauty, society, compassion, nature, family, wonder, diversity, humanity….

This theory is a little rough.

Two points:

First, people know well how wealth is created.

Person A creates something she hopes Person B wants. Person B creates something person A can use. If they exchange voluntarily, each profits. Each is better off than before the exchange, If not, neither would agree to trade. Wealth has been created.

Second, poverty is humanity’s base condition. Poverty is created by birth. Only when wealth creation exceeds human reproduction, can poverty be reduced.

Your concern, I think, is not wealth creation, but power.

Hear hear!

For all his polysyllabic profferings, the altruistic author doesn’t understand the simple mechanism whereby wealth is actually CREATED. An explanation that is understandable by anyone with the merest modicum of analytical acumen, is in this article:

http://conservativeread.com/the-simple-logic-of-wealth-creation/

Cheers!

There is a difference between easily understandable and correct. But I will attempt a shorter, more monosyllabic version. Wealth is a relative concept. I can get wealthier than you, but I have not necessarily created any wealth in doing so. Let’s say I’m a UK private landlord. You can’t afford the deposit on a house, so you come to me and pay me rent to use the asset that I have and you don’t (housing). I become rich. You don’t die of exposure. But where has wealth been created?

By concentrating the money in one place (my bank account) am I making the overall amount of wealth any greater than it was? By giving you the use of my roof over your head am I making anyone (apart from me) any wealthier? Not you, don’t forget I have taken from you an amount of money, not given you any. And I am now wealthier by precisely the amount that you are poorer. The fact that a roof over your head is worth more to you than having a spare house is to me is a facet of an existing inequality (and I don’t mean that in a value-laden way, just a factual one). As such, I may feel ‘up’ on the deal but actual value has not been added at any stage. The house was always ‘worth’ whatever it was as a rental property, so long as people like you were willing and able to pay for it’s use at that value. And that worth is a red herring in any conversation about ‘wealth creation’ as it’s only what I would take from you, not magically generate.

OK, so trade. I own a company that makes biscuits/cookies. I sell lots of them. You buy a packet, and eat them. You are poorer by the cost of a packet of cookies, and I am richer. You have had the benefit of a packet of cookies. I get to keep some, the workers get some money, the cookie ingredient supplier does, the power company etc. Your money has been redistributed – horray! But where has the wealth been created? Can you point to the part of this in which money appears from nowhere? (There may be an answer to that, but neo-liberal dogmatists won’t like it).

The article linked to above just repeats a dogma, it does not serve to explain anything. In places it segues into irrelevancies where it cannot form a coherent argument (the fact that companies do less well in a recession does not show that money is being created in a sales transaction. Any more than the fact of tides shows the earth is flat and mounted on a see-saw).

Money is printed all the time, and the amount in circulation is carefully controlled. It economically illiterate to assume more magically appears when someone becomes wealthy – in fact it is Mad Hatter logic – and yet it is the unquestioned mantra of our age.

In 100 years time, people will look back with the same mild amusement as we do at those who believed the earth was flat.

“But where has the wealth been created? Can you point to the part of this in which money appears from nowhere?”

I can. Your example starts with the game half-over. Before I got the money for the packet of biscuits, I didn’t have that money. I traded (for example) some of my time for some money. So in truth I traded not money for your biscuits, but a bit of my time. I valued my time less than the biscuits; you valued the biscuits less than my time. Neither of us had money before, now we both do. Or in truth, we each had a smaller amount of money prior to the exchange and now we each have more.

Your analogy of money to matter/energy is false; I’d go so far as to say dangerous. Its simple conclusion is that my gain causes pain to others. To this I ask, how then is it possible that all humans living today are better off than all humans alive in 1100? Yes I include kings. I’m comparatively poor by the standards of my community but wouldn’t consider switching places with King Henry I of England (one word for you if you doubt me: Dentistry).

This is the dumbest thing ever written by a human.

Why did you waste my time

you are a fukcing idiot

Your inability to understand it doesn’t make it dumb.

The origins of wealth from the article is nature. And society takes this from nature, then stamps logos and impales a price tag on it. You can’t say that this is mine, but deny other peoples the land that you stole from the commons. It shows that divisions in equality ‘power’ are just lines we draw to raise other peoples above others. I see it as a nice way of suggesting that we need to start valuing the existence of nature, which we share as something that bullies shouldn’t have the right to take from us. I think we are far gone. There are enough steamed brains, but I believe that the ones who are offended are the ones to which one referred to as freedom-fryers. It is an interesting allusion as you see freedom as being able to buy back something in the past was once everyones. It seems simplistic to say we can grab stuff from everyone but it happens today and is about to get worse with this next administration. They will fry our freedoms further than we know because they disrespect our nature, humanity, & many followed the hate blindly into an oligarchy.

What do you think of this idea?

Wealth = idea + time + material

Wealth therefore is produced when we take resources from the earth. When Larry Lumberjack creates wood planks from trees, he is creating wealth: the trees had no prior value. He had an idea: “Carter Carpenter could use wood planks to make chairs”. He then used his time to make the planks, and then sold them to the Carpenter. Thus the Lumberjack turned a tree of no value into something valuable.

Brilliant article. The entropy in the economic system is a reflection of the entropy within each of us – within our systems. Our beliefs, our thoughts, the very way the brain is wired.

One must truly know where one is before any intelligent change can occur. This article does a great job of helping us to see where we truly are. Without clarity on this – any changes would result in an unpredictable trajectory.

It is many times uncomfortable to see where/who we are but the “value” in see that clearly is priceless.

If I sell a painting for $100,000, did I not create wealth? I gained a $100,000 to be used to better my life and the buyer gained a painting worth $100,000 that may go up in value in the future. If it does, then he would have created wealth too.

Wealth is not a pie of natural resources. The author is greatly mistaken.