“Despite plunging oil prices and a weakened euro, the ranks of the world’s wealthiest defied global economic turmoil and expanded yet again. For our 29th annual guide to the globe’s richest, we found a record 1,826 billionaires with an aggregate net worth of $7.05 trillion, up from $6.4 trillion a year ago.”

These are the lines Forbes wrote a few weeks ago to analyze its 2015 Billionaires List.

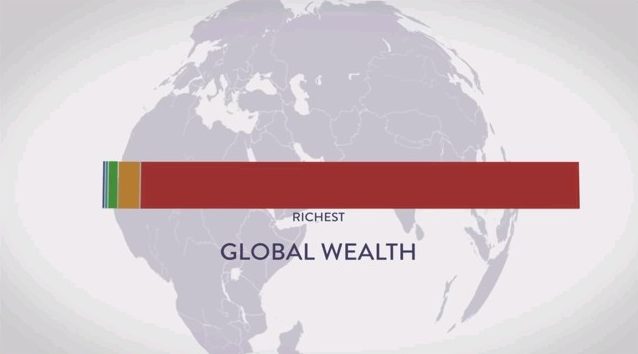

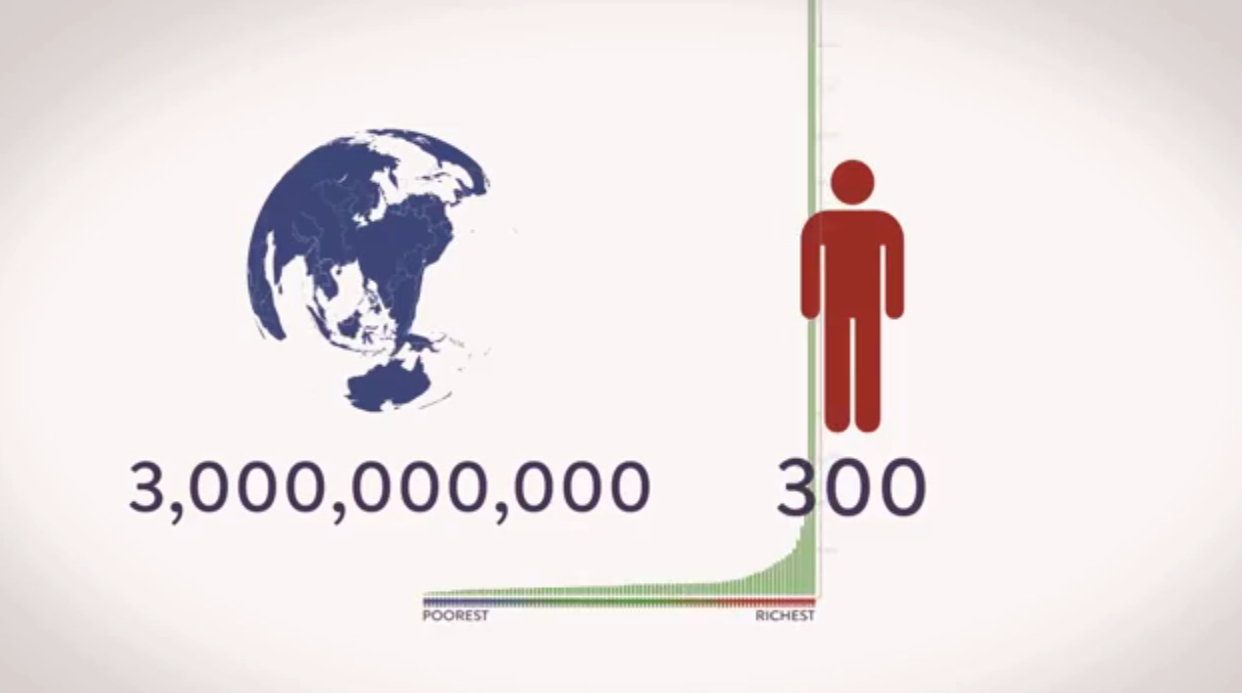

While the rich keep getting richer, the poor seem to be getting poorer. Statistics indicate that now globally 1% of people own 41%; top 10% own 86%. Or how about this one: “The 85 richest people are as wealthy as poorest half of the world.”

In Europe, a part of the population is spiralling into poverty. In Germany, a country that’s supposedly not being hit too hard by the eurozone crisis, the middle class is shrinking at a rapid speed; in 1997 some 65% of Germans were identified as middle class but this number had dropped to 58% in 2012, meaning that over 5 more millions had fallen under the poverty line.

Paris is also under the spotlight: The French national statistics office warned of a 50% increase in homelessness in France from 2001 to 2012, meaning that there are now more people sleeping rough in Paris than other big European capitals.

During the same period (2001-2012), 15 million people fell into poverty in the US (+50% compared to the previous period), the largest number of poor people in half a century. The middle class cumulated wealth decreased by 30%, while the top 0.1% wealthiest families has increased their share by 40%.

Where is our world going?

If you’ve ever played Monopoly, you know how the game is designed: except unwise choices made, the player who is close to winning keeps extracting money from the other players who are gradually falling into debt.

In real life, this principle is valid for individuals and also organizations such as small local shops that suffocate in debts while some large corporations are taking it all, making always higher profit.

People used to rely on their communities to meet their needs and solve their problems but the money system tends to erode them. If you start to introduce money in an existing community, behaviours change: members will understand quickly that the game is designed in a way that it’s more interesting for them to maximise their self-interest than the common interest. Gradually, such selfish behaviours destroy the community and favour individuality, leaving people abandoned to themselves.

Left behind, many need to do hard jobs for low wages that are sometimes beneath human dignity to make a living; during past travels I saw in many countries disabled people, kids and elders forced to become trinket-touting vendors in order to survive. The adage “work harder and persevere in order to succeed” is no longer true as studies – such as the one conducted by Thomas Piketty – show most of the rich have inherited their wealth while the rest of the people work in a rapidly changing context where they master only a limited amount of parameters. And as we know, spiralling to debt and poverty is often linked to the rise of issues such as criminality, poaching, drug dealing, human, weapon trafficking, etc.

How can this be the system of a society that calls itself civilised? Can only governments work at solving these issues of wealth inequality, poverty and their connected problems? How can money stop fuelling the powers in place and instead bind and unite us? What are the alternative models to meet our needs that are more respectful for all our brothers and sisters as well as our environment?

Good questions to ask, Thomas. The massive impact of finance on society means we should pay attention to the kinds of connections created by financial institutions. More can be found here: http://relationalthinking.net/relational-finance/

Predictable since at least 1990 in America, globally since at least 2003.

Worse now than ever! Free market competition without rules, or government stability & regulations can only fuel and accelerate the crisis.