Humanity isn’t poor. We’ve just been robbed of our collective inheritance.

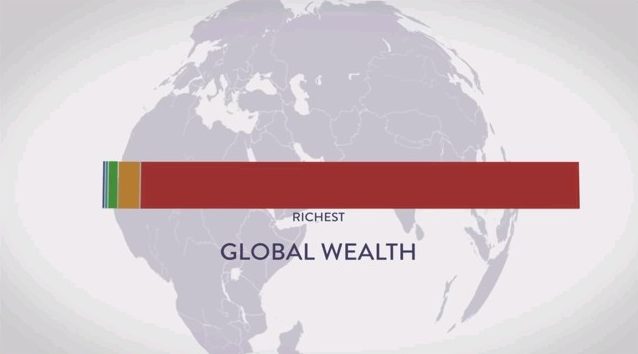

When you look at an image like this, where 1% of the people have almost all of the wealth, a question quite naturally comes to mind:

Is THIS why it feels like there isn’t enough money to go around? Might it be the case that there is enough money but it is very unfairly distributed?

As the research director at TheRules.org for the last three years, I have gotten to learn a lot about wealth inequality and poverty. Our mission is to change the rules of the global financial system to bring poverty to an end and make it possible for humanity to transition to planetary sustainability. This is not a mission we take lightly either.

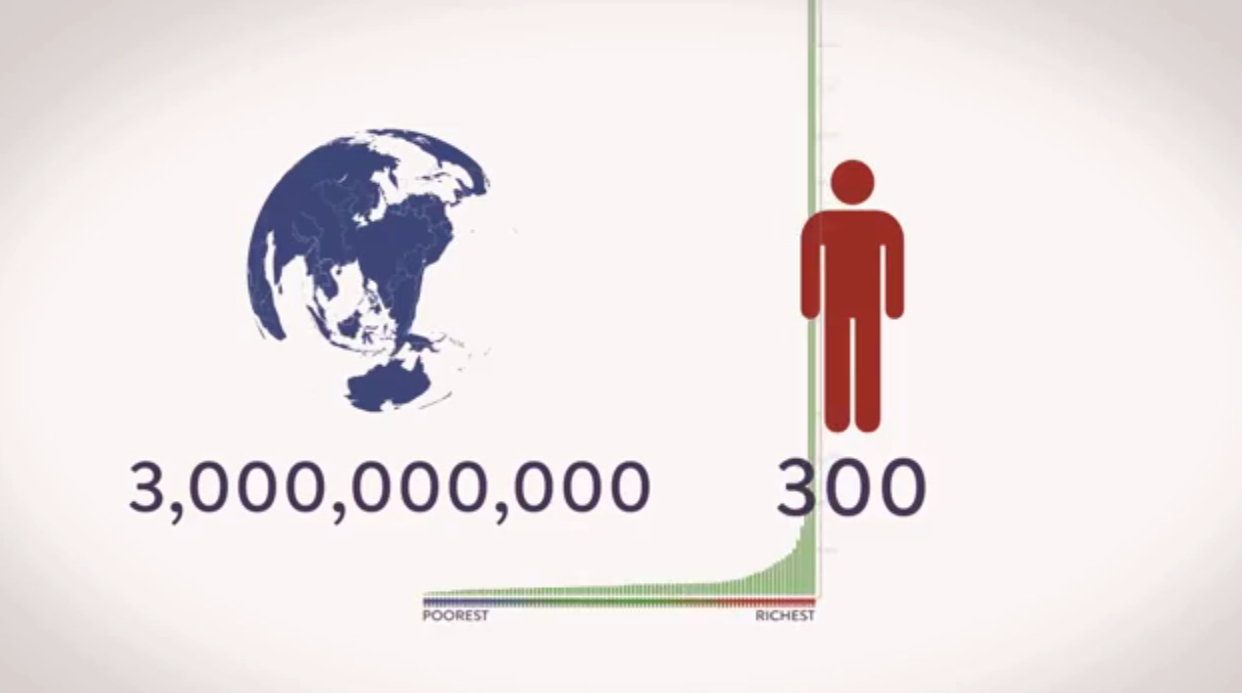

When we create graphics like this one — showing that 300 people have the same aggregate wealth as 3 billion — it is important to ask ourselves if this is a feature of the system, not merely a fluke. What we find when we explore this possibility is that indeed it is true that the game has been rigged to serve financial elites. They made the system behave this way. Poverty and wealth inequality are there on purpose as natural consequences of the logic behind wealth accumulation.

One of the rules that creates this outcome is the use of tax havens to extract and hoard wealth. Thanks to excellent work at the Tax Justice Network, there are estimates for how much money is syphoned out of the real (traslation: productive) economy and squirreled away by the super rich.

Note that number in the bottom of the image — $21 Trillion — is the low-ball estimate for how much money has been extracted from the world economy and hidden from view. Compare this to the size of the total economy and you will see why it feels like there isn’t enough.

Measured in GDP (gross domestic product) the global economy is approximately $73.48 trillion in absolute size. In other words a full one-third of the global economy has been stolen and hidden from view! No wonder it feels like there isn’t enough to go around. If money were blood it would feel as if two pints were gorging and pulsating in our big toe while the heart struggled to find enough to fuel our lungs, muscles and brains.

This metaphor — of money as circulation — is central to George Cooper’s account of what is wrong with our financial system. In his book Money, Blood and Revolution: How Darwin and the Doctor of Charles I Could Turn Economics Into A Science, Cooper explains how a circulatory model of global finance resolves many of the ideological problems of Neoclassical economic theory. It is an essential piece of the puzzle for understanding where poverty and inequality come from.

If we want to create a more equitable (and functional) world, we will need to keep money in circulation. When a major portion of it has been stolen away — I use that word intentionally because the elites use their money to shape policy outcomes (and steal wealth for themselves) so they can accumulate more wealth and power — there will not be money available for food, health care, education, employment, or any of the other things most people care about.

I have an idea floating around in my head that translates this despairing situation into one of hope. I asked myself one simple question: What if we somehow captured the tax haven money and taxed it at 10%, returning the revenue to national governments to fund social programs? With an estimated $21 trillion as the minimum amount in the global tax haven system, that would generate more than 2 TRILLION DOLLARS in funds for human security and the transition to sustainability.

Rather than say what I would do with that amount of money, I leave you to ponder this question yourself:

What would you do with $2 trillion to help humanity?

Would you invest in the clean energy revolution? Provide basic income for every living person on Earth? Offer free university education to all people? Eradicate disease? Restore the health of soils? Reforest the Amazon? There are just so many possibilities!

The money is there. It is rightfully ours to take (see here for why I make this strong claim on collective ownership). And we have the power to shine a light into the tax haven system with current digital technologies. What we lack is the will to do so.

With that in mind, I leave you to contemplate…

Dificult choice. I would invest in searching the right people to provide answers for a better possíble future. And in helping tbem, of course.

I really like your idea here, Barbara. Gets me thinking about what it would feel like if some kind of wisdom council formed to guide the global transition… how would they answer this question?

Education is clearly going to be very important, so long as it is done well. We will definitely need a lot of emotionally mature people with the right combination of knowledge, training, social skills, and capacity to manage immense amounts of social change.

Seems to me this is a “mission critical” piece of the puzzle!

Clean water, food, clothing, shelter, education/training, medical and dental for everyone in the world. With a healthy and educated world arts and sciences would flourish. A worldly renissance would spring forth and the sunlight would stream down from the clouds upon the faces of the downtrodden and up lift, embolden and sustain all life forces. Actually it’s probably all being held by a silly, small group of dopes who have a lot of fear.

Hi Rachel,

I am struck by the tension you’ve captured in your comment — between the immense abundance of wealth that already exists in the world and the fear-based, scarcity-oriented thinking that drives so many to cling to what they have and not share it appropriately.

This builds nicely on the discussion Barbara and I are having in the comments above, where we’ve noted the importance of having the right kind of leadership culture combined with a longer-range play to cultivate human potential through the best education practices available.

Definitely things worth investing in!

Hi Joe ,

Firstly, good analysis on global wealth inequality …. i gone through ur article just now, really impressive efforts by u and ur organisation to deal with the poverty and its consequences …

These are my views on global wealth inequality ,

To understand about the high priority problem, i started understanding about the basic need of the human, are they only food,clothes and shelter ?

On my analysis i realised there is some thing more needed to all humans and i call it as NEW TRIANGLE OF BASIC NEED OF ALL HUMANS .. i e.,

EDUCATION

MONEY

POWER

Every person need to have all the three in required proportions to leave a happy life.

Education – empower self , money – it is interconvertible medium to full fill all basic requirement like (food, cloth , shelter and many more ) and power -(it is all about being togetherness, being united )

After further analysis , i realised money playing a key role among the rest of the needs , Since in todays world money gets u education and power, which intern gets u more money . So every body is behind accumolating more and more money and cycle will never stops until one realise money can’t get u time(can’t make human immortal ).

so after reverse analysis on spending of money by humans , i realised people are spending more money to protect self and family on the name of health and they are not even close to self sufficient because of demand and supply mismatch of health care service receivers and health care service providers.

So , it means we are not self suffiecient , Being rich or being poor is always a transition by different factors like being happy , being healthy & young(physical and mental ) , being secure , being contained with time (life – age) .

Rich by money can be poor by the rest of the factors at-least by time, if he has every thing still he lives only to max 100 years.

Therefore , 300 people (richest people on ur analysis) has to max 300,000 life years but the poor 3 billion x 100 life years each = 3 trillion life years , So , they are poor by money but rich by time and their power is their unity and how they spend their time in togethore …

The most productive way of spending time is getting educated , only education can teach them how to invest time to become wealthy.

But to my knowledge being wealthy is being healthy , so if u really want to invest your 2 trillion dollars to benefit 3 billion people to get rid of the poverty from their lives , INVEST IT ON HEALTH EDUCATION .

And i will always give my support to you and your organisation to SOLVE THE GLOBAL WEALTH INEQUALITY .

Hello Dr. Dixit,

I resonate deeply with your observation about political power. The relationship between inequality of material resources (not having enough food, shelter, etc.) and inequality of power (where it is concentrated for use by elites to control economies in self-serving ways) is a fundamental issue for dealing with poverty creation.

There is a long history of wealth hoarding in different civilizations. And always the consolidation of political power is a key feature of those social systems that produce inequality and poverty.

Very best,

Joe

DR CHIRANJEEVI DIXIT ,

dr.chiranjeevidixit@virtucure.com.

INDIA

Correction , in my post (not 3 trillion life years but 300 billion life years)*

“or any of the other things most people care about”. **

This is a very strong sentence.

Perhaps we can look also at where the money is spend on. And see if it is any of the things -most people care about-. We don’t care about campaigns or accumulating money. We care about normal people things. So it’s actually just a few on this world that DO care about campaigns and accumulating money. That is actually also a good thing.

Also, while saying that, I can FEEL the threatening sound of the sentence: people don’t care about what is good for everyone, people are too stupid to know what to do with money.

Let’s collect the beliefs about inequality. Because we carry them too.

I am hardly shocked about the division of money. It’s like I feel… as if it would be dangerous to hand all that money to “just normal people”.

“what are they gonna do with it” “they don’t know any thing about….” “we’ve been in politics for …., my great grand etc used to”.

“We have had to work hard, to stand where we are” “We’ve made a lot of sacrifices”.

We’ll we all do, right? And we all can choose to make sacrifices and that actually just means you are giving up on things you actually want to do for something you do not want to do. Otherwise you would notice it. (Say if you love to take long walks but you cant because you have to drive to work you’ll miss it. If you love to drive, you have no problem going to work).

All these things echo in our head. Let’s get rid of them. Let’s notice them.

Because we can’t change if we are not aware.

It is in a way the same for a couple who stays together, one beating up the other, the other staying.

We are scared our heads will get chopped of. As that is what might have happened for a long time when we stood up for ourselves.

Counter question:

Why do you think these people, these 300 people, and that other small group (how much is that), why do you think they accumulate money and skew rules?

In the line of normal people behavior we are social and share, so why don’t they? Some of their beliefs are heavily skewed too! They probably are convinced the world is a certain way, and when you are convinced of something it is that way. Do they feel the world is a scares, dangerous place and by believing that they create it, for everyone else? What would happen if they integrate this shadow side of themselves?

What if we integrate our fear to become like them?

We might be scared to become like them as we “take away their money” (weeeeeeh). Yet we don’t really take it from them, we take it back. They have had there share of time to play with it. Now it’s time for us again to play with it. We should also stop being scared that the money will accumulate again but this time in the wrong hands. Because money that is accumulate is always in the wrong hands. See your comparison to blood. It is never a good thing.

Last but not least,

Can you create a what if page?

If we can create a visible outtake on how it would be if we all have our own money. We would not need insurance actually. The money that I get back now from health insurance is actually already mine?

** “the elites use their money to shape policy outcomes (and steal wealth for themselves) so they can accumulate more wealth and power — there will not be money available for food, health care, education, employment, or any of the other things most people care about.”

Hey Jules,

You’ve commented on so many things here. I’ll just pick one to respond to… the distinction you make between caring about money and caring about things in life that money may (or may not) provide. I like to think about this in a very simple and concrete way by noting how the pursuit of money is like confusing a restaurant menu with the meal. The menu has no nutrition and cannot even be eaten. The same can be said for money. Money will not bring happiness. It does not deliver health or comfort. The things we buy with money (in a Neoliberal system where all things of value have been monetized) are what we actually care about.

When we recognize the misallocation of value (confusing money for wealth), it becomes a tool of power to be wielded by those who have monetary wealth.

I love your idea of creating a page to explore how the $2 trillion might be spent. Could you post a blog here at TheRules website that invites people to share their thoughts and ideas? That would make for an interesting conversation!

Best,

Joe

I heard something amazing today.

A pig farmer in the Netherlands started to use probiotics to clean the piglets environment. This (among other things) reduced the use of antibiotics with 95%.

So this gives us a sum: To get a desirable outcome (health of pigglets) we should not fight against it (use anti-biotics) which causes resistence, we can add the natural counter pool (probiotics) and the outcome is balance.

We have some bad bacteria that grow when there are not enough good bacteria. Adding good bacteria works better then fighting some of the bad.

Unsolved:

So if we translate this to the money situation (think a bit meta, not in actors and can or can’t, think a bit mathematical). What is it that causes the imbalance in the natural balance of flooding wealth (the streaming of the blood).

What is the anti-biotics in this story, what is the misbalance of the bad bacteria and what is the pro-biotics?

So how do we translate this to money?

What are the bad bacteria? Are it the rich people? Or are it the poor people? It is a bit odd but it might actually be the poor people. Because we try to get rid of poverty, but yet we get more of it.

So we need not anti-biotics but probiotic. How did we fight poverty? And what would the probiotic be?

Another great tip is to think along the line of the ocean project .org.

Instead of chasing the plastic (Yang) they build something that has two strong arms and just embraces and catches the plastic as it comes along (Yin).

Is there a Yin tactic here?

It’s nice to see there is an(other) initiative aiming at eliminating / reducing poverty. It (therulesblog.wpengine.com) may be in place for some time now, but I came to know about it just now.

What I see mostly on this kind of platforms is these maps, graphs and statistics which show how bad the situation in the world is. Lots of efforts and research put in to proving that there is a REAL imbalance of wealth and how this One percent is sucking the blood out of the remaining 99. What I think should be more focused is how to reduce this imbalance. For that I appreciate therulesblog.wpengine.com’s efforts.

For solutions; I’m sure you must be researching different alternatives to the current financial systems which, to a large extent, have caused and increasing the imbalance. I would like you to consider the Islamic Financial System as a credible alternative and do some research on its viability for application around the world. I may be biased towards this system being a Muslim, but would like you to see it in pure objective, technical, financial terms, away from any religious prejudice. See it not because it’s ‘Islamic’ financial system, rather only to see whether it is a possible alternative.

When searching for solutions, I don’t think it’s wise to disregard something more than a billion people trust (but unfortunately few have the chance to benefit from) just because you (and this more than a billion alike) don’t like the actions of a few thousand of them.

Dear Emal,

Thank you for bringing up the wisdom tradition for financial management that has been cultivated through the religion of Islam. I also feel strongly that we have much to learn about “moral accounting” from our historic faith traditions. A wonderful book that explores the historic roots of economic thought in our various ethical traditions is The Economics of Good and Evil by Tomas Sedlacek. His work is a reminder that good economic thinking is often found within the verified practices of our ethical traditions — and in particular, those of our organized religions that have proven capable of standing the test of time.

Important stuff!

Joe

If we believe that human poverty is linked to a lack of money, then spreading the money around solves the problem, and we all live in happy harmony.

But what are the consequences of all 7 billion humans have enough money to buy into the success paradigm of the current system?

The success of a money driven economy depends on consumption. If we all pushed up our consumption to a level in which we can sustain jobs that pay a living wage to perhaps 25% of humanity, the result will be environmental disaster.

The planet cannot sustain a consumer economy that aims to support all of humanity. Currently the consumer economy is supporting 1% of humanity and look at the environmental impact.

The rules we have to change are far more fundamental that just spreading the money around.

The changes that need to take place will not come from those who have control of money, why should they change? All is well in their world.

Those that do not have money have to reject outright the consumer money driven system. A much more difficult mental challenge, as we have been indoctrinated to believe that having more money will solve all our societal/environmental problems. It won’t, it will amplify them.

The fundamental problem is in what we reward, whom we reward, how we reward, and the centralized control of the reward. That is not to say there should be no reward, but to understand that reward drives behavior.

I completely agree with you, Annette. I recently read a fantastic article by one of the creators of the Ecological Footprint about the difference between ecological economics and environmental economics — the first based on science and the second an attempt to translate everything environmental into the Neoliberal frame of monetary value. This distinction, as you so powerfully describe in your comment, is of fundamental importance.

If we get the fundamentals of economics right, we can build an inclusive system for shared prosperity. But if we get the fundamentals wrong, it won’t matter how we spread the money around because it will just end up back where it started.

Very best,

Joe

No amount of money will fix a system controlled and made over the past 400 years by people who convinced them self’s they are superior to rule over others. This idea is a natural thing its called survival of the strongest all humans have it in one way or another. Rich humans can do allot more damage using money because it means power. Poor people are just the same but they don’t have the power. The solution is simple you can not make people change but you can take away to power bit by bit so they do less damage to others.

I would spent 2 trillion undermining people and systems with to much power.

I’ve heard two things that have impressed me about wealth: both involve regulations on a global scale:

1. If we don’t become more sustainable we are all doomed anyway, rich and poor alike. So. Impose a Global Green tax that reflects the True Cost of items in our planetary economy. When a product exploits the environment, a culture, labourers, a species or extracts resources irresponsibly, a analytics system must be devised to reflect its True Cost. Not a deregulated, offshore, exploitive, untaxed system based on finding the lowest manufacturing price for higher profits, but one that displays a products effect on the holistic economy. Source: ‘The Ecology of Commerce’

2. Create caps on monopolies. Period. No company to have profits exceeding a realistic & manageable figure. Eg: 5 billion dollars – before it is broken up & regulated to smaller entities. “Too big to fail” is not true Creative Capitalism. It is one of excessive bailouts and tax subsidies whereby the human public supports its own demise, and shares none of the wealth or benefits. The opposite in fact.

I dunno. Food for thought, but wrestling wealth back from the obscenely rich is not going to be easy, if possible at all. They’ve rigged the game so completely that Revolution seems the only way forward. And history proves that unreliable, as systems always revert to a “Will To Power” that rationalizes corruption and greed.

It might not be the best Idea, but 2 Trillion dollars is roughly what it would cost (extrapolated from the cost of the Large Hadron Collider) to build a particle accelerator that spans the circumference of the moons equator.

Perhaps its not the wisest idea to spend 2 trillion to help understand the fundamental building blocks of the universe, but I think that scientific advances are one of the best way to promote cultural equality.

If I had 2 trillion dollars to spend half would go to medical, yes. that’s right 1 trillion gone. Why? When you have that kind of money what matters most to you?

The answer to this question is life! The average man can only live to about 82 years. What if you could extend it another 100 years and keep the cycle going.

The rich stay rich and the poor stay poor while you enjoy your long life with your power, money, and your own personal team developing methods to extend your life another 100 years. People with that much money look outside the box trying to bring fiction to reality.

We want to live forever even if it means spending a trillion dollars to get there, not all of it just some…

Whats to say there isn’t already brain transplants happening to the top 1%… What? You think they would tell you? Now thats what I would spend my first Trillion dollars on, the other Trillion would be used enjoying life now that I live longer.

Just because you don’t hear about it or see it on the news or the web doesn’t mean its not possible, just means its kept in secret.

Thank you,

SLR

The Parashooran Paradox

What is the “Paradox of Parshooram” ? The man copulated wuth his mother,on the instructions of his father – who was an impotentica sage.The Hindoo Model,is that the Gods sent the husband of Brahmin wives,to jungles for penance and austerities – while the Hindoo Gods, seduced the wives of the Brahmins,and mated with them.

The father of Parshooram,did not want to mate iwth his wife,as he was on a celibacy trip.Hence his son banged mommy – but the Kshatriyas saw the kid.To hide the shame and guilt – the son and poppy,blamed the Kshatriyas – and theh killed all the Kshatriyas ! In Hindooism,incest is normal – even Gan-pati mated with his mother.

This is all a “copy and paste”,from Greek Theology and Creativity.dindooohindoo

Net result – all the Kshatriya men were dead, and their women were on heat – and so,they copulated with the Brahmins,to breed a “new race” of Kshatriyas.These “mew” breed had the DNA of the Brahmins (cowards,weasels and impotenticas) and the DNA of their mothers (which is “whoring”) – the “born agains” Kshatriyas.

The Disaster

When the Sakas,Scythians,Turks,Afghans,Mongols,Central Asians,Greeks,Persians, Abyssinians etc., attacked Hindoosthan – there was no martial race left,as the “real” so called Kshatriyas were killed.These Kshatriya cowards,joined hands with Babar and the Brits and the Portugese to kill and rape Hindoos.These “rat” Kshatriyas were called Rakpoots,Jats and Sikhs etc.

The DNA of these “born again” Kshatriyas (as stated above),explains Y the Hindoos were raped again and again and again and again (The DNA of Poppy – The Brahmin – and so were,their women.This also explains Y the Rajpoots sold their women,like whores,to the Mughals and the Brits – to save their lives and money (The DNA of their 1st mommy).

This also explains Y the Sakas,Scythians,Turks,Afghans,Mongols, Greeks,Persians, Abyssinians etc.,who stayed back in Hindoosthan,and married locals – also produced cowards,weasels,idiots and impotenticas.

The Curse

It is all the curse of Parshooram – the Curse of Incest and the Curse of Hindooism. Just like the curse of Ishvaku – whose own kids from the same mommy married each other – and then lineaged into Rama,the coward and impotentica.

Rama – captures the disaster the doom of the Hindoo race,and the Hindoo DNA – which is Y the Hindoo Muslims and Nassara,are treated as trash,all over the world – with real Muslims and Jesuits

AND RAVANA DID NOT DIE !

WHICH MEANS THAT SEETA MAIYA WENT WITH RAVANA WILLINGLY AS SHE WAS SEDUCED BY HIM !

SEETA MAIYA MIGHT HAVE HAD AFTER THOUGHTS ! BUT SHE WENT WITH RAVANA WILLINGLY – PERHAPS UNDER SEDUCTION OR HYPNOTISM – BUT THE NEPALI RANDI SEETA WENT WILLINGLY WITH RAVANA

What is MAIYA that you kept mentioning? Please clarify.

Hindoos are squeamish about the rape of Seeta Maiya.The fact is that Seeya Maiya was raped by Ravana and she performed fellatio on Ravana !

Hindoo poetry has a poetic way of describing rape – as we will see later.dindooohindoo

Seeta herself states in the Yuddha Kanda that she was banged by Ravana

PHASE 1 – RAMA OPENLY TELLS SEETA MAIYA THAT SHE MUST HAVE BEEN FUCKED BY RAVANA

Book VI : Yuddha Kanda – Book Of War

Chapter [Sarga] 115

कः पुमांस्तु कुले जातह् स्त्रियं परगृहोषिताम् |

तेजस्वी पुनरादद्यात् सुहृल्लेख्येन चेतसा || ६-११५-१९

“Which noble man, born in an illustrious race, will take back a woman who lived in another’s abode, with an eager mind?”

न हि त्वां रावणो दृष्ट्वो दिव्यरूपां मनोरमाम् |

मर्षयेत चिरं सीते स्वगृहे पर्यवस्थिताम् || ६-११५-२४

“Seeing you, who are endowed with a beautiful form and attractive to the sense, detained for long in his abode, Ravana could not have endured your separation.”

PHASE 2 – SEETA HERSELF ADMITS THAT SHE WAS DRY FUCKED BY RAVANA – BUT WHILE SHE WAS LAID – HER HEART HAD ONLY RAMA THE LIMPDICK ! THESE ARE THE WORDS OF SEETA MAIYA !

Book VI : Yuddha Kanda – Book Of War

Chapter [Sarga] 116

यद्यहं गात्रसंस्पर्शं गतास्मि विवशा प्रभो |

कामकारो न मे तत्र दैवं तत्रापराध्यति || ६-११६-८

“O lord! It was not my willfulness, when I came into contact with the person of Ravana. I was helpless. My adverse fate was to blame on that score.”

मदधीनं तु यत्तन्मे हृदयं त्वयि वर्तते |

पराधीनेषु गात्रेषु किं करिष्याम्यनीश्वरा || ६-११६-९

“My heart, which was subservient to me, was abiding in you. What could I do, helpless as I was, with regard to my limbs which had fallen under the sway of another?”

PHASE 3 – THE CONCLUSIVE PROOF OF SEETA’S RAPE 30000 FEET IN THE SKY !

THE HINDU SANSKRIT POETRY OF RAPE ! dindooohindoo

Book III : Aranya Kanda – The Forest Trek

Chapter [Sarga] 52

उद्धूतेन च वस्त्रेण तस्याः पीतेन रावणः |

अधिकम् परिबभ्राज गिरिः दीप इव अग्निना || ३-५२-१५

When her ochreish silk sari’s upper fringe is upheaved by air onto to Ravana, Ravana looked blazing like a mountain set ablaze, muchly and overly. [3-52-15]

There is a lawmakers describe,as a “Christian genocide” and systemic persecution under Nigeria’s sharia and blasphemy laws.

There is be an designates Nigeria as a “Country of Particular Concern” for religious persecution.

There is a pathetic mothering ! He is an exchanger of the Goa father and a mother ! Goa are a back should be kid bather !

The Goa backer should be asked like a fast and be hacked to first time ever due to what it termed systematic, ongoing, and egregious violations of religious freedom, violent Boko Haram attacks, and frequent ethno-religious conflicts exacerbated by the judiciary system.

The Goa should be discovered and killed and kicked !

The Goa is a mother and is Pramod Sawant and is kicked as a hick and kicked !

The Goa backer is a Pramod Sawant (born 24 April 1973) and is,Hindoo mucker and a “Christian genocide” hacker and will all be ducked and kicked and

with Hindoo fucker and Christian Motherfucker

Since 2009, over 52,000 Christians have been murdered, 20,000 churches and faith institutions destroyed, and dozens of villages wiped out,with the

Nigeria, AND BE EXPLAINED WITH THE GOA WHAT SOUTH WHICH WILL THE HINDOOO AND CHRISTIAN WITH GOA BACK OUT AND BACKER.

Boko Haram and ISIS-West Africa as Entities of Particular Concern,and these HIGH PEACE TO HOT AND GOA AND KICK THE Hindoo mucker and a “Christian genocide” and hacker

Kick the Goa blacks and these backouts.